美国北方天空研究公司(Northern Sky Research,以下称NSR)的《平板卫星天线报告(第二版)》近日发表,并预测到2026年,平板天线设备的累计销售额将达到91亿美元。

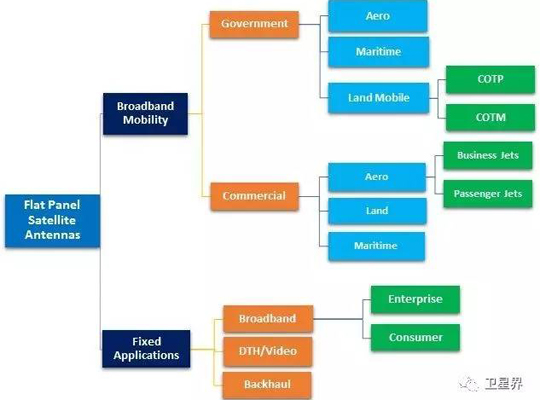

作为在这一新兴技术领域中唯一的多用户报告(multi-client report),其文中指出对于制造商来说,航空设备将驱动收入的增长,同时非同步轨道卫星的固定宽带业务将占据主体市场份额。

平板天线,或者确切来说,相控阵天线从上世纪80年代起就开始部署使用,但主要受成本和性能因素影响一直不温不火。NSR分析师,该报告的合著者之一Prateep Basu表示:“没有哪一种特定的平板天线技术能满足所有需求,因为每个市场不光有各自特定的性能需求,还有不少管理负担与经济限制。”

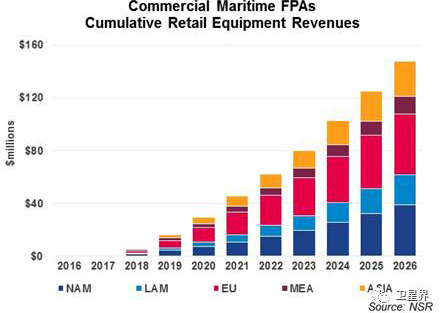

虽然在移动市场中愈发收到欢迎,针对移动应用的平板天线预计将仍维持高价,这主要归因于其技术的复杂性。NSR同时预测到2026年,得益于机上连接、海上休闲以及已有的政府部门陆地移动业务需求的快速增长,移动业务部分的收入在平板天线设备总收入中的占比,将超过92%。

卫星宽带应用受OneWeb和SpaceX等公司的低轨高通量卫星星座运营情况带动,是固定卫星业务发展预测的主要影响因素。至预测时间段截止前,200万颗更低价格的平板天线将被部署以向中东和亚洲等地区提供服务。

“当今市场很明显被商业航空连接业务主导。但是,新的平板天线制造商在卫星产业价值链中所采用的合作模式,将有助于提升特定市场的垂直发展速度。这也将塑造一种面向明确需求的商业模式。”NSR分析师及报告的另一位合著者Dallas Kasaboski补充道。

原文阅读:

IT’S A MOBILE WORLD FOR FLAT PANEL ANTENNAS

NSR’s Flat Panel Satellite Antennas, 2nd Edition(FPA2)report, released today, forecasts cumulative FPA equipment sales to reach $9.1 billion by 2026.

As the only multi-client report on this emerging technology, NSR’s FPA2 finds that aeronautical equipment will drive revenue growth for manufacturers, while fixed broadband services from non-GEO satellites will be the main volume market.

Flat Panel Antennas (FPAs), and more specifically, phased array antennas, have been deployed since the 1980s. Their cost and performance have been the major factors holding back the potentially ‘game-changing’ technologies.? “There is no one specific FPA technology that fits every need, as each market has its own specific performance requirements that come with the weight of regulatory and economic constraints,” stated Prateep Basu, NSR Analyst and report co-author.

Technical complexity of FPAs for mobile applications is expected to keep antenna prices high, even as they become more viable in mobile markets. Combined with the rapidly rising number of airlines pursuing in-flight connectivity, large leisure maritime markets, and the established land-mobile government sector, NSR expects mobile applications to drive FPA revenues, accounting for over 92% of total FPA equipment revenues, by 2026.

Satellite broadband applications, driven by the expected operationalization of LEO-HTS constellations like OneWeb and SpaceX, are the main drivers of the Fixed Applications forecast, delivering services over 2,000,000 lower-priced FPAs by the end of the forecast, primarily to the Middle East and Asia.

“The market today is clearly dominated by commercial aviation connectivity markets.? However, partnership models that new FPA manufacturers are adopting across the satellite industry value-chain can be expected to accelerate vertical market-specific development.? This will also shape business models that cater to a definite demand for such equipment,” added?Dallas Kasaboski, NSR Analyst and report co-author.

粤公网安备 44030902003195号

粤公网安备 44030902003195号